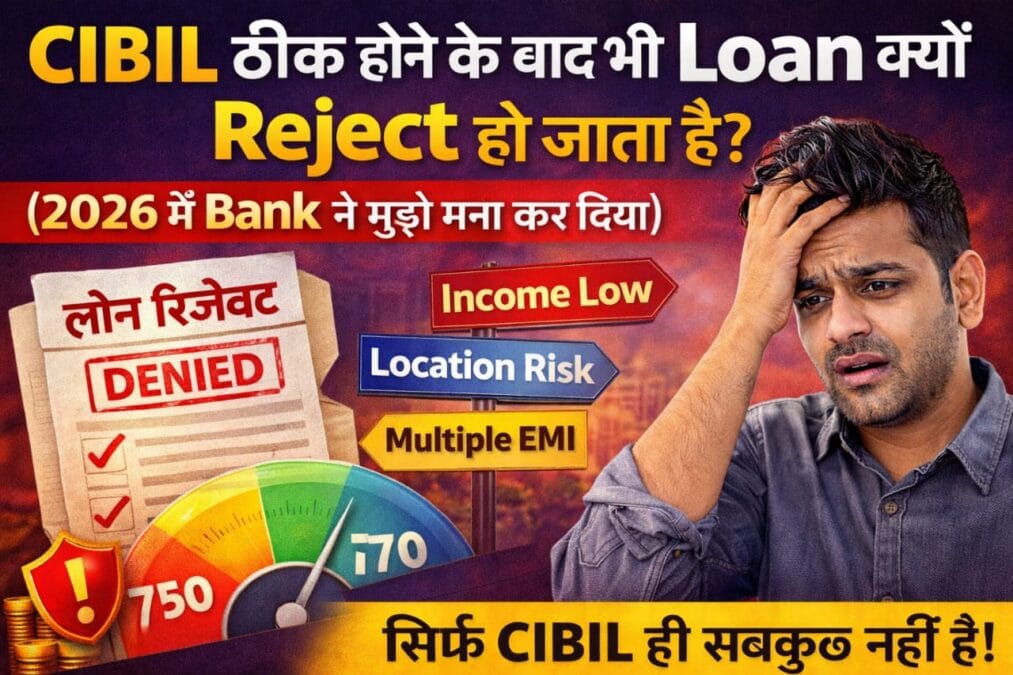

Loan Reject Hone Ke 10 Real Reasons (2026) – CIBIL Sahi Hone Ke Baad Bhi Kyun Bank Mana Kar Dete Hain?

Bahut saare log yeh sochte hain ki agar CIBIL score 700+ ho gaya to loan milna pakka hai. Lekin 2026 me reality kuch aur hi hai. Har din hazaron log aise hain jinka score theek hone ke baad bhi personal loan, home loan ya business loan reject ho raha hai.

Main is blog me aapko real experience + bank ke internal reasons bata raha hoon, jo normally koi openly nahi batata.

🔴 Real Example (True Case)

Ramesh (नाम बदला गया) ka CIBIL score pehle 528 tha. Usne 6 mahine me score improve karke 726 kar liya. Phir bhi jab usne ₹3 lakh ka personal loan apply kiya to bank ne bina reason bataye reject kar diya.

Reason? CIBIL nahi, balki niche diye gaye points 👇

1️⃣ Income Stability Proof Nahi Hona

Bank sirf amount nahi, income ka pattern dekhta hai. Agar aap freelancer, daily wage ya irregular income wale ho to risk high maana jata hai.

Solution: 6–12 mahine ka bank statement clean rakho, same narration aur regular credit dikhao.

2️⃣ Job Change Bahut Zyada Karna

2026 me banks data-driven ho gaye hain. Agar aap har 6–8 mahine me job change kar rahe ho to system automatically red flag laga deta hai.

Solution: Kam se kam 12 mahine ek hi employer ke sath continuity dikhao.

3️⃣ Overdraft / Credit Card Limit Full Use

CIBIL score high hone ke baad bhi agar aap 90% credit utilization use kar rahe ho to loan reject ho sakta hai.

Bank mindset: “Score acha hai, lekin aadmi already pressure me hai.”

4️⃣ Multiple Loan Applications (Hard Enquiry Trap)

Agar aap ek hi mahine me 4–5 apps ya banks me loan apply kar dete ho to system samajhta hai ki applicant desperate hai.

2026 Rule: 30 din me max 1–2 enquiries hi safe hoti hain.

5️⃣ Location Risk (Silent Killer)

Kuch PIN codes ko banks internally high risk zone mark kar dete hain – chahe aapka CIBIL perfect ho.

Example: Temporary address, industrial area ya frequent address change.

6️⃣ Employer Blacklist Me Hona

Yeh sabse shocking reason hota hai. Kai NBFCs ke paas company-level risk list hoti hai.

Aapki company me pehle loan default hua ho, to aap bhi reject ho sakte ho.

7️⃣ Age Factor Ignore Karna

Age 21–23 ya 58+ hone par banks risk zyada maante hain, especially personal loan me.

Solution: Co-applicant ya secured option try karo.

8️⃣ CIBIL Report Me Old Closed Loan Update Nahi

Kai baar loan close hone ke baad bhi report me “active” dikhta rehta hai.

Tip: Free CIBIL report check karke dispute raise karo.

9️⃣ Salary Mode Cash Hona

2026 me banks cash salary ko seriously nahi le rahe.

Solution: Salary account me credit hona mandatory banta ja raha hai.

🔟 Internal Bank Policy (Jo Kabhi Batate Nahi)

Har bank ka apna risk appetite hota hai. Kabhi-kabhi sab kuch theek hone ke baad bhi system mana kar deta hai.

Iska matlab yeh nahi ki aap unfit ho – bas bank mismatch hai.

👉🏻2026 में बिना CIBIL Score Loan कैसे मिलेगा? | Complete Hindi Guide

👉🏻Instant Personal Loan Apps 2026 – Safe List & Fake Apps Se Bachav

👉🏻Fake Loan Apps List 2026 – Dangerous Apps के नाम, पहचान और शिकायत कैसे करें

👉🏻Low CIBIL Score Improve Kaise Kare (2026) – 30, 60, 90 Din Ka Practical Plan

❓ FAQs

Q1. CIBIL 750 hone ke baad bhi loan kyun reject hota hai?

Kyuki CIBIL ke alawa income, job, location aur internal risk bhi check hota hai.

Q2. Reject hone ke baad turant dusra loan apply kare?

Nahi, kam se kam 30 din ka gap rakho.

Q3. NBFC zyada chance dete hain?

Haan, lekin interest zyada hota hai.

Q4. Bank reject kare to kya kare?

Profile improve karo, secured loan ya co-applicant try karo.

Q5. Kya loan rejection CIBIL ko affect karta hai?

Direct nahi, lekin enquiry zyada hone se impact padta hai.

✅ Final Conclusion

2026 me sirf CIBIL score loan ki guarantee nahi hai. Bank aapki poori financial life scan karta hai.

Agar aap smart approach se apply karte ho, sahi bank choose karte ho aur galtiyan avoid karte ho – to loan milna mushkil nahi hai.

👉 Next Step: Apni CIBIL report + bank statement dono ek sath analyze karo, tabhi apply karo.