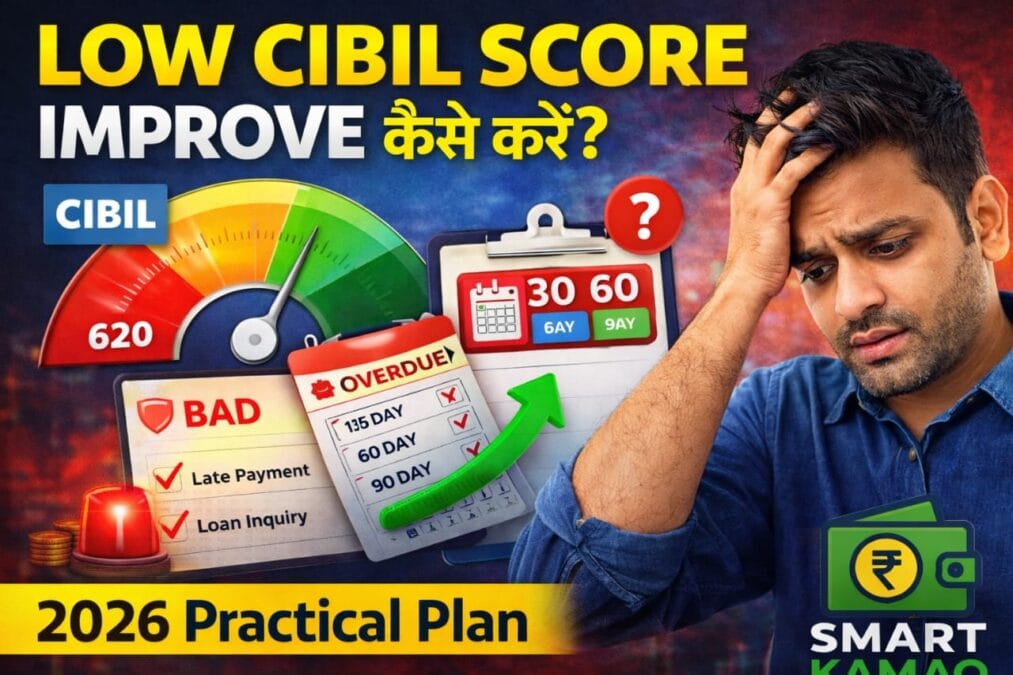

Aaj ke time me agar aapka CIBIL Score low hai, to loan, credit card ya EMI milna mushkil ho jata hai. Lekin achhi baat ye hai ki CIBIL score improve karna possible hai – bas sahi strategy aur thoda patience chahiye.

Is article me hum bilkul real aur practical tareeke batayenge jisse aap apna low CIBIL score 30, 60 aur 90 din me dheere-dheere improve kar sakte hain.

Low CIBIL Score Kya Hota Hai?

CIBIL score 300 se 900 ke beech hota hai.

- 750+ – Excellent

- 650–749 – Average

- Below 650 – Low / Poor

Agar aapka score 650 se neeche hai, to bank aapko risky borrower maanta hai.

CIBIL Score Low Kyun Hota Hai? (Main Reasons)

- EMI ya credit card bill late payment

- Credit card limit ka 80–90% use

- Bahut zyada loan enquiries

- Loan default ya settlement

- Galat entry credit report me

Note: Sirf ek late payment bhi score ko kaafi girata hai.

30 Din Me CIBIL Score Improve Karne Ka Plan

✔️ Step 1: Apni Credit Report Check Karein

Sabse pehle free me apni CIBIL report check karein aur dekhein:

- Koi galat loan entry to nahi

- Closed loan abhi open to nahi dikh raha

- Late payment marking galat to nahi

✔️ Step 2: Pending Bills Turant Clear Karein

Credit card ya EMI ka jo bhi pending amount ho, use clear karna sabse fast improvement deta hai.

✔️ Step 3: Credit Utilization 30% Se Kam Rakhein

Agar aapke card ki limit ₹1,00,000 hai to ₹30,000 se zyada use na karein.

60 Din Me CIBIL Score Improve Karne Ka Plan

✔️ Step 4: Minimum Payment Kabhi Miss Na Karein

Har month due date se pehle payment karein. Auto-debit on karna best rahta hai.

✔️ Step 5: New Loan / Credit Card Apply Karna Band Karein

Har enquiry se score girta hai. Jab tak score improve na ho, naye loan se door rahein.

✔️ Step 6: Small Credit Line Use Karein

Agar possible ho to small amount ka loan lein aur time par repay karein – ye positive signal deta hai.

90 Din Me CIBIL Score Improve Karne Ka Plan

✔️ Step 7: Old Credit History Ko Active Rakhein

Puraana credit card band na karein. Old history score ke liye achhi hoti hai.

✔️ Step 8: Settlement Avoid Karein

Loan settlement se score improve nahi hota, balki long-term damage hota hai.

✔️ Step 9: Credit Mix Balance Rakhein

Sirf personal loan ya sirf credit card – dono ka balance hona achha maana jata hai.

CIBIL Score Improve Karte Time Ye Galtiyaan Na Karein

- Fake apps se loan lena

- Multiple apps par ek saath apply karna

- Minimum due bhi miss karna

- Galat advice follow karna

FAQs – Low CIBIL Score Improve Kaise Kare

Q1. CIBIL score kitne din me improve hota hai?

Minimum 30–90 din lagte hain agar discipline follow kiya jaye.

Q2. Kya bina loan liye CIBIL improve ho sakta hai?

Haan, credit card usage aur timely payment se ho sakta hai.

Q3. Kya settlement ke baad score improve hota hai?

Nahi, settlement score ko long term tak damage karta hai.

Q4. Ek month me kitna score badh sakta hai?

10–30 points possible hain, situation par depend karta hai.

Q5. Low CIBIL par loan milega?

Kuch NBFC aur apps dete hain, lekin interest zyada hota hai.

Conclusion: Discipline Hi Sabse Bada Formula Hai

Low CIBIL score koi permanent problem nahi hai. Agar aap time par payment, limited usage aur patience rakhen, to 3–6 mahine me achha score ban sakta hai.

Next Step:

👉 Agar aap low CIBIL ke bawajood loan options dekhna chahte hain, to ye guide bhi padhein:

👉 2026 Me Bina CIBIL Score Loan Kaise Milega – Complete Guide

👉 Instant Personal Loan Apps 2026 – Safe List & Fake Apps Se Bachav

👉Fake Loan Apps List 2026 – Dangerous Apps के नाम, पहचान और शिकायत कैसे करें